Throughout a financial advisor’s career they take many continuing education classes to help them stay current and advise their clients in the best way possible. |

Continuing Ed: Helping Create Quality Financial AdvisorsContinuing education helps financial advisors stay informed of

the latest industry and regulation changes while educating them on products and

solutions to help their clients. Taking continuing education classes helps them

become better at their job, too! Providing quality service by having the product

knowledge to present the right solution while following state laws and

regulations, is the responsibility of both the advisor and the companies they

represent. Continuing education helps to create a quality financial industry

through knowledge.

Financial advisor licenses renew every two years if the

advisor has completed all the continuing education required by their resident

state. A financial advisor will lose their ability to advise and recommend

financial products and lose their livelihood if they don’t meet their

continuing education requirement. Insurance Commissioners in each state are tasked

with ensuring advisors have maintained their education requirements and haven’t

had any derogatory or legal claims against them. In addition, financial

advisors are dually monitored and regulated by the SEC (Securities Exchange Commission) and FINRA, depending on the advisor’s licensing.

Each state determines how many continuing education credits

are required every two to four years and which classes are mandatory, such as 3

hours of ethics training currently required in all 50 states. Advisors that are

licensed in multiple states must meet each state’s requirements in order to

maintain that state’s license. For this reason, many states have streamlined

their class offerings so that each class is approved for multiple-state

licenses.

Some advisors have designations or areas of specialty that

require them to take additional classes beyond the minimum required. These advisors

provide advice in certain areas, offer unique services or financial products and

select their classes based on their specialty.

Throughout a financial advisor’s career they take many

continuing education classes to help them stay current and advise their clients

in the best way possible. If you have questions regarding my special areas of

focus or education classes I’ve taken, feel free to ask. Click here for printable version

|

|

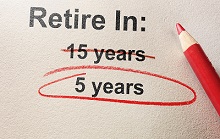

| New IRS Changes for Retirement Plans in 2019The IRS announced last month in November cost-of-living

adjustments to limits on contributions to retirement plans for 2019. There

hasn’t been an increase in some plan types since 2013, which is why now is a

great time to take advantage of maximizing retirement contributions. According

to a 2017 FINRA study,10% of American retirement savers are

contributing the maximum allowed, are you? Here’s the breakdown of the 2019 IRS changes for retirement plans:

401(k)s, 403(b)s, most 457 plans, and the

federal government's Thrift Savings Plan will rise to $19,000 next year, up from $18,500 in 2018.

IRA contributions (Pre-Tax, Roth, or a

combo) rose to $6,000 from

$5,500, the limit that has been in place since 2013.

Catch-up contribution limits if you’re 50 or older in 2019 remains unchanged

at $6,000 for workplace plans and $1,000 for IRAs.

SEP IRA or a solo 401(k) goes up from $55,000 in 2018 to $56,000 in 2019,

based on the amount they can contribute as an employer, as a percentage of

their salary. The compensation limit used in the savings calculation also goes

up from $275,000 in 2018 to $280,000 in 2019.

SIMPLE retirement accounts goes up from $12,500 in 2018 to $13,000 in 2019.

The SIMPLE catch-up limit is still $3,000

Defined

Benefit Plans goes up from

$220,000 in 2018 to $225,000 in 2019.

Deductible IRA Phase-Outs for taxpayers making contributions to a traditional

IRA is phased out for singles and heads of household who are covered by a

workplace retirement plan and have modified adjusted gross incomes (AGI)

between $64,000 and $74,000. For married couples filing jointly, in which the

spouse who makes the IRA contribution is covered by a workplace retirement

plan, the income phase-out range is $103,000 to $123,000 for 2019.

Roth IRA Phase-Outs for taxpayers making Roth IRA contributions is $193,000 to

$203,000 for married couples filing jointly. For singles and heads of

household, the income phase-out range is $122,000 to $137,000.

If you

aren’t contributing the maximum into these types of retirement accounts you can

increase what you’re contributing overall. If you have questions about these

increases or want meet regarding your overall saving and investing, now is the

time to plan for 2019.

Click here for printable version

|

The IRS announced adjustments to limits on contributions to retirement plans for 2019, making right now a great time to take advantage of maximizing your contributions. |

QLACs are a great way to guarantee an income stream in retirement that you can't outlive and have an RMD age of 85. | Qualified Longevity Annuity Contracts: Making Your $ Last for LifeAmong the primary concerns people have as they approach

retirement is, “How long will I live and will my money last?” In addition to

traditional retirement savings such as employer-sponsored retirement plans,

there’s now another type of retirement account that guarantees you won’t go

broke during retirement. Qualified Longevity Annuity Contracts (QLACs) allow

you to invest 25% or $130,000 (whichever is less) from your IRA or 401k into

this type of annuity. QLACs are different from more traditional types of

annuities.

Currently, 3% of large U.S. companies offer QLACs as part of

their 401k plans. These companies see QLACs as a good option for retirees to

access money after their pre-tax assets are depleted because of the guaranteed

income stream they provide and the ‘late in life’ required minimum distribution

(RMD) requirement.

Some retirement planners refer to QLACs as a ‘personal pension plan’ because when the annuitant starts distributions, they are guaranteed the payments

for the rest of their life. QLACs are used as part of a retirement portfolio

strategy because of these unique features:

- Payments can begin anytime between ages 70 ½ and 85 (The RMD

age is 85)

- QLACs can be funded from a qualified retirement plan,

Traditional IRA or Roth IRA, or with after-tax dollars.

- Originally designed by the Internal Revenue Service, the QLAC must meet certain requirements for it to be a QLAC.

- QLACs are not issued by every insurance company and not

every annuity can be used as a QLAC

- QLACs can be ‘layered’ and funded during an individual’s working

years for use in retirement.

- Since QLACs are issued by an insurance company, buyers must

be aware of the financial stability of the issuer. For this reason, buying QLACs

from multiple companies should be considered if part of a retirement strategy.

- Distributions are taxed at an individual’s regular tax rate

Most QLACs offer an inflation rider, which increases

payments as the cost-of-living (COLA) is adjusted by the IRS at the same time

Social Security payments are increased.

QLACs are a way to guarantee an income stream in retirement

that you can’t outlive. If you’re interested in finding out more or which

companies issue annuities that meet the IRS’s QLAC requirements, contact me for

additional information.

Click here for printable version

|

|

| Safeguarding Your Personal Information Online and OfflineHere in the U.S., our personal information is exposed daily

at frequencies and levels we’ve not experienced before. It doesn’t take a data

breach from a technology company to expose us, we are doing it to ourselves without

being aware. Each time we use technology (Facebook, Instagram, online exposure)

our personal information is gathered by companies and used to market to us or

sold to other interested parties for the same purpose.

Earlier this year the State of California passed legislation to limit what technology companies gather from internet users,

but only when they have the user’s consent. Although this has more to do with

online activities such as social media, shopping or opting in to receive

something ‘free,’ people need to realize their exposure to risk when they

participate online.

Europe has personal privacy data laws it strictly enforces, but the U.S. currently doesn’t have federal laws to protect an individual’s

personal information from being exposed by their own internet activity. What

can you do to protect yourself both online and offline?

1. Don’t provide information about yourself on your social

media profiles. This includes contact information, your birth date, where you

went to school, or who your relatives and children are, for example. Keep your

profiles secured and not public. The only way to eliminate your social media

profile information from being compromised is to not have a profile or

participate in social media.

2. Don’t provide information for ‘free downloads’ from

websites, unless you know or do business with the company asking you to provide

your information. The information they request is usually your email address

for delivery of the free information.

3. Routinely change your online passwords and keep them in a

secure place (if you write them down).

Eliminate online security issues by typing website addresses into your

browser each time and don’t use the same password for multiple accounts.

4. Destroy your personal documents yourself or have a

business destroy the documents in front of you. If you leave your documents in

the hands of someone else, you have no guarantee your information won’t be

shared.

5. Keep your financial information in one place, preferably

locked up and secured. Keep only year-end information, original policies and

contracts along with updates. Keeping a ‘paper trail’ exposes your information

and isn’t necessary since financial companies you do business with can provide

you with the information you may need.

We don’t always think about protecting our personal

identifying information or our important documents until something happens. One

of our greatest losses can be prevented by thinking through how we can protect

our personal information. Everything

from life insurance policies, birth certificates, social security cards,

passports, home and car titles, and even photos should be protected in addition

to what is virtually available about us on the internet.

Click here for printable version

|

One of our greatest losses can be prevented by thinking through how we can protect our personal information. |